COMPARATIVE ADVANTAGES BETWEEN COMMUNITY FOUNDATION vs. FOUNDATIONS

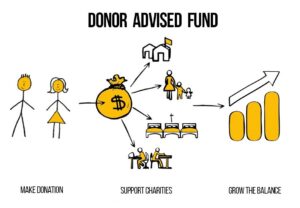

A Donor-Advised Fund [DAF] is a powerful way to elevate the impact of your philanthropy and strengthen your return on investment in the community. A Donor-Advised Funds a re a simpler, more flexible and efficient alternative to creating a private foundation. You can contribute as often as you like and receive the maximum tax deductions allowed.

A Donor-Advised Fund can support the causes and communities that matter most to you, while the Community Foundation administers grants to your preferred charities [local or national]. And the community Foundation provides regular online quarterly statements about the performance of grant distributed from the fund.

| PRIVATE FOUNDATION | DONOR-ADVISED FUND AT COMMUNITY FOUNDATION |

|

|---|---|---|

| LEGAL IDENTITY | Separate nonprofit entity | [Donor’s Choice of Name] Fund of the Community Foundation |

| TAX STATUS | Private foundation | Public charity |

| TAXATION OF INVESTMENT INCOME |

2% annually | None |

| PAYOUT REQUIREMENT | Grants must equal 5% of corpus annually | None |

| DEDUCTIBILITY OF GIFTS | Deductibility: 20% AGI for appreciated property, 30% AGI for cash |

Deductibility: 30% AGI for appreciated property, 50% AGI for cash |

| ADMINISTRATION | Detailed annual filing with IRS | All record-keeping and accounting carried out by the Community Foundation |

| GRANTMAKING EXPERTISE | Professional staff, if any (unusual for a small foundation) |

The Community Foundation staff reviews and monitors proposals, transacts all distributions. |

| CONTROL | Trustees have complete control of distributions and responsibility for asset management. | Donor-advisor may make grant recommendations. |

| COST | Costs include annual legal and accounting fees, insurance, investment management, office space, staff, and miscellaneous expenses. |

No cost to establish. 1% annual fee |